In a significant move for the digital economy, President Ferdinand Marcos Jr. has signed into law a Value-Added Tax (VAT) on Digital Services. This law applies to overseas e-commerce firms and popular streaming platforms like Netflix, HBO, and Disney, imposing a 12% VAT on digital services provided by foreign companies. This legislation marks a crucial step in regulating the rapidly growing e-commerce sector in the Philippines.

Expanding the Tax Net

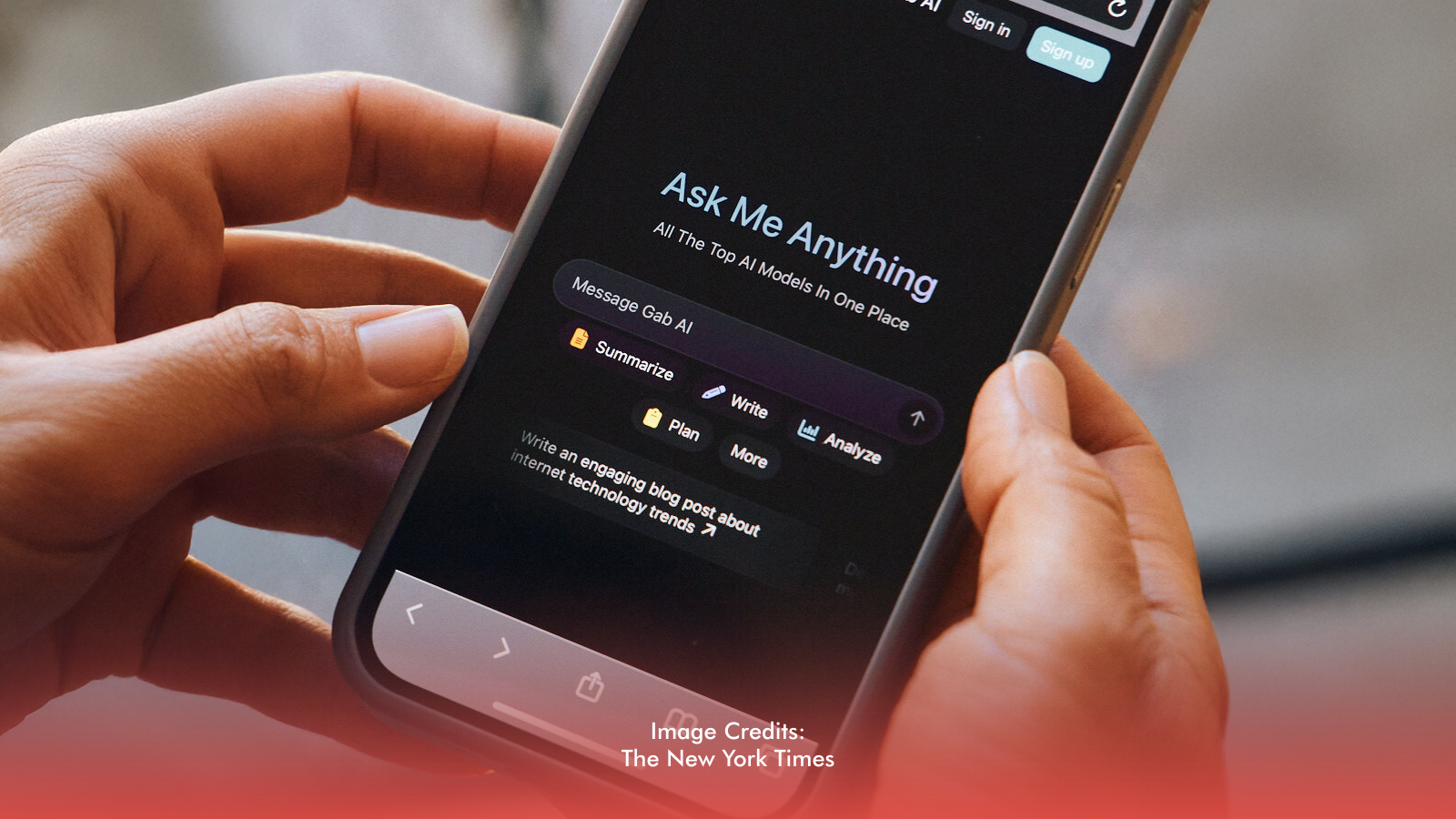

Republic Act 112023 targets a wide range of digital services, including streaming content, electronic marketplaces, software licensing, online advertising, and social networking platforms. By including these foreign entities in the tax system, the government aims to level the playing field for local businesses that have faced disadvantages. This initiative not only addresses revenue gaps but also acknowledges the reality of a digital economy where consumers increasingly rely on foreign services.

Boosting Revenue and Supporting Public Services

The Department of Finance projects that the VAT on Digital Services could generate between ?80 billion and ?145 billion from 2025 to 2028, depending on how well these companies comply with the new tax requirements. This potential influx of revenue is crucial for funding various public services and initiatives, providing much-needed resources in areas like education, health, and infrastructure. By capturing revenue from foreign providers that benefit from Filipino consumers, the law seeks to strengthen the country's fiscal position and support broader economic growth.

Modernizing Taxation for Today’s Economy

This new law amends certain provisions of the National Internal Revenue Code of 1997, reflecting the urgent need to update tax regulations to keep pace with technological advancements. As digital services continue to grow exponentially, modernizing the tax framework is vital for ensuring its effectiveness and relevance. By implementing VAT on these services, the Philippines is not just catching up; it’s setting a precedent for how to effectively navigate the challenges posed by the digital economy.